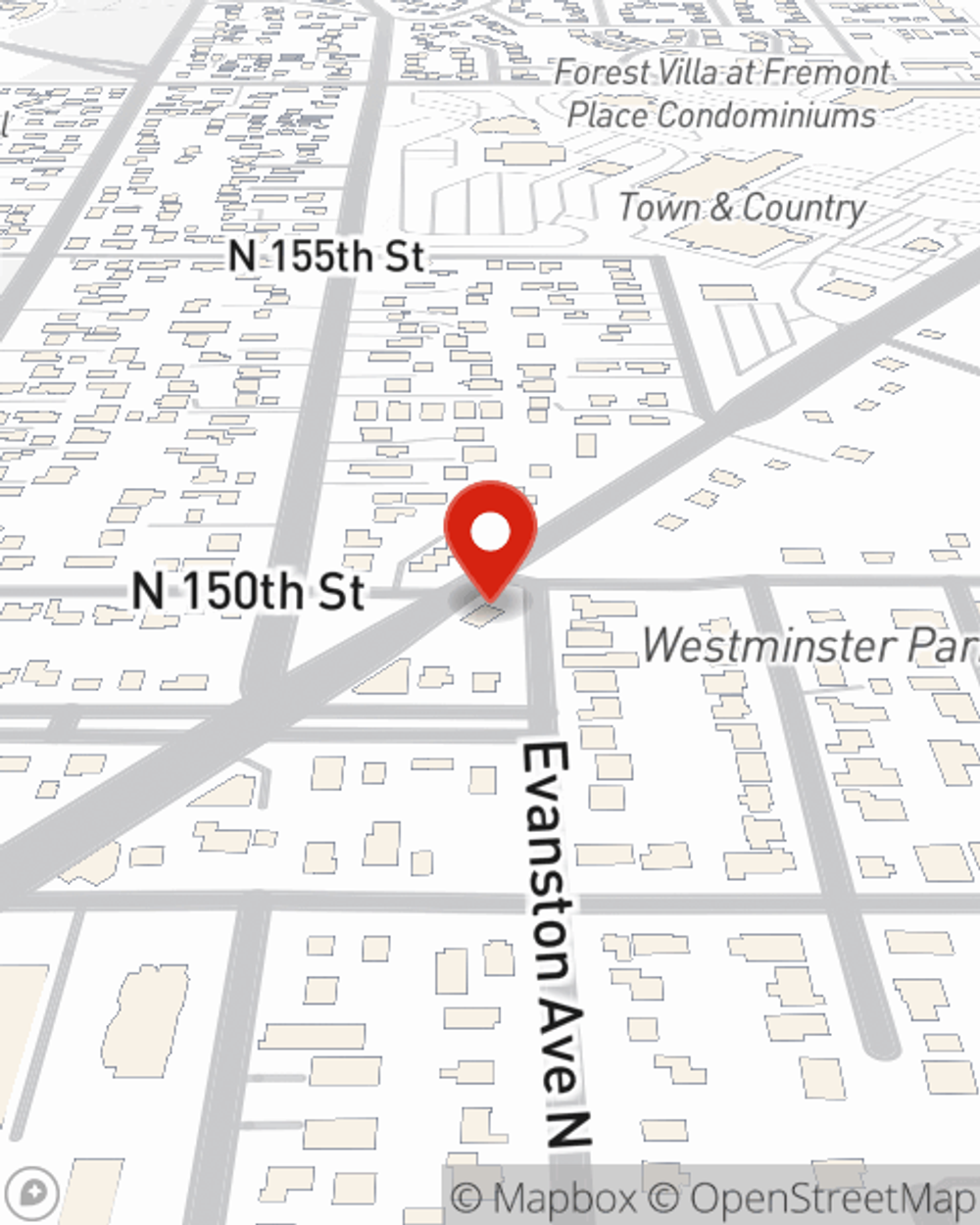

Insurance in and around Shoreline

Bundle policies and save serious dollars

Protect what matters most

Would you like to create a personalized quote?

- Shoreline

- Seattle

- Edmonds

- Bothell

- Lynnwood

- Kenmore

- Lake Forest Park

- Woodway

- Mill Creek

- North Creek

- Redmond

Personal Price Plans To Fit Your Needs

Life is often unpredictable. We understand your need to help protect what matters most. With State Farm insurance, you can arrange a Personalized Price Plan® that's right for you, your loved ones, and the life you've built. Contact agent Erin Ison with your questions about safe driving rewards, and bundling options and discounts.

Bundle policies and save serious dollars

Protect what matters most

Insurance For Every Step Of The Way

As the largest insurer of automobiles and homes in the U.S., State Farm is equipped and experienced when it comes to helping you protect the life you've built with outstanding coverage options, excellent service and competitive prices.

Simple Insights®

Benefits of Medicare Supplemental Insurance

Benefits of Medicare Supplemental Insurance

Supplemental Medicare insurance can help you pay for some of the out-of-pocket health care costs that aren’t covered by Medicare. Learn how it works.

How to compare the cost of living if you're relocating

How to compare the cost of living if you're relocating

New job? Awesome. Have to move? Here's how to perform a cost of living comparison to ensure your move doesn't lead to unexpected financial considerations.

Simple Insights®

Benefits of Medicare Supplemental Insurance

Benefits of Medicare Supplemental Insurance

Supplemental Medicare insurance can help you pay for some of the out-of-pocket health care costs that aren’t covered by Medicare. Learn how it works.

How to compare the cost of living if you're relocating

How to compare the cost of living if you're relocating

New job? Awesome. Have to move? Here's how to perform a cost of living comparison to ensure your move doesn't lead to unexpected financial considerations.